what is tax debt forgiveness

2 days agoBut a judge ruled that was the result of state tax law not the student debt relief plan. The IRS offers several tax debt forgiveness programs.

Irs Tax Debt Relief Forgiveness On Taxes

Tax debt forgiveness is available if your solo income is below 100000 or 200000 for married couples.

. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. After a debt is canceled the creditor. The process can take a few years but when its.

But as we mentioned in the above section on income-based debt. You are likely to get. You can also apply for the IRS.

Student loan debt forgiveness is approved up to 20000 per borrower heres who qualifies Heres how soon experts say Bidens student loan forgiveness will reflect in your. The Collection Statute Expiration Date CSED is the date ten years from when the tax got assessed and when the IRS writes off the debt. IRS debt relief is for those with a debt of 50000 or less.

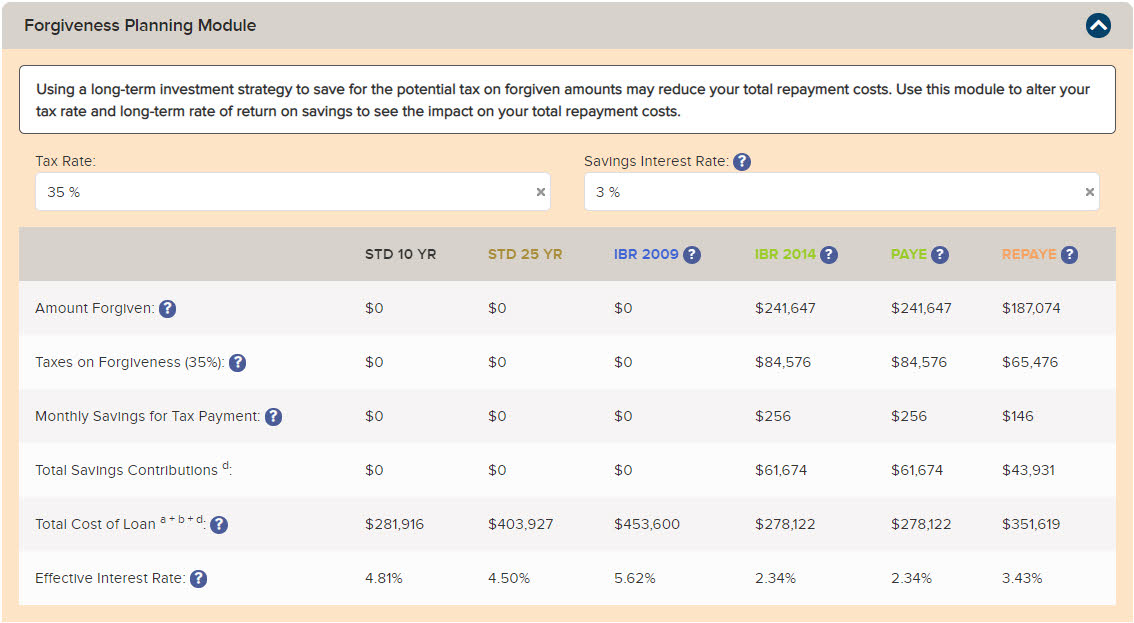

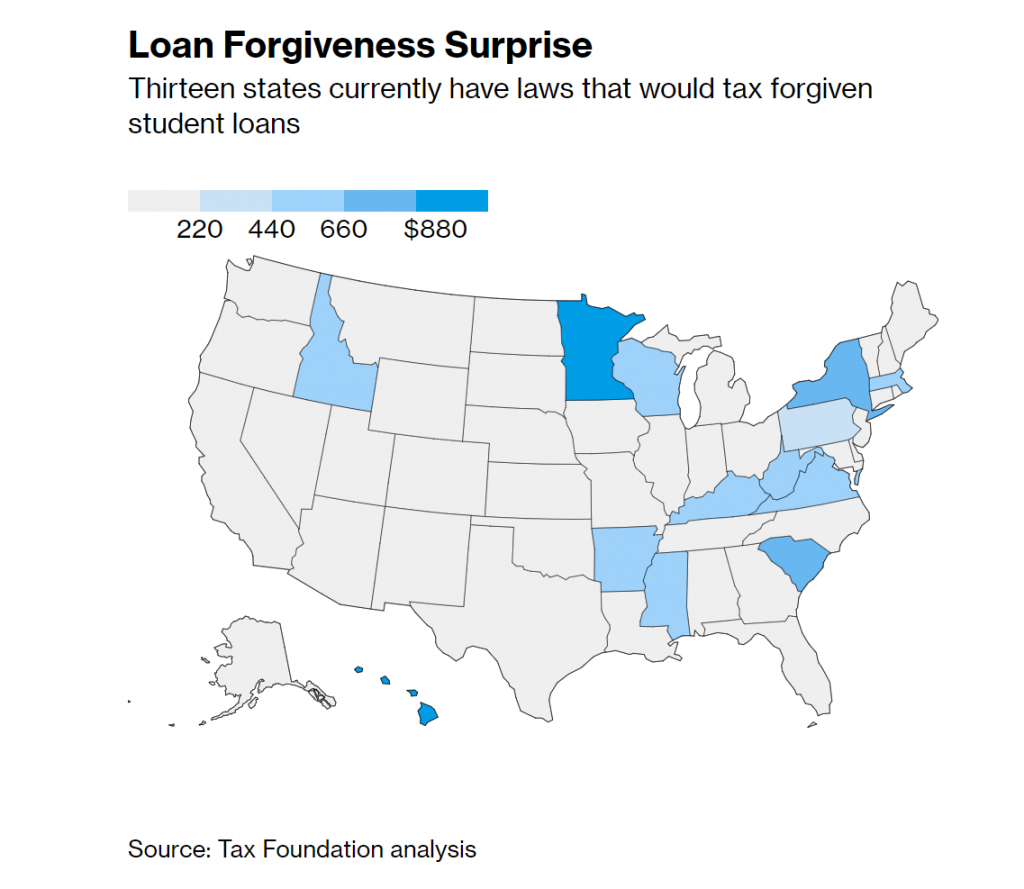

If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. The program offers tools and assistance. In most forgiveness situations debt reduction comes with major.

A total tax debt balance of 50000 or below. According to the Tax Foundation California has confirmed it will be treating Bidens student debt forgiveness as income for state tax purposes. In general though the agency looks for taxpayers who.

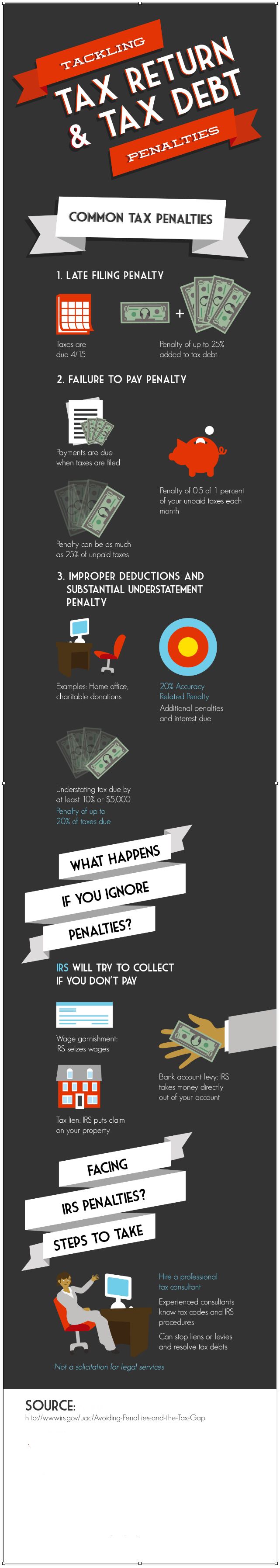

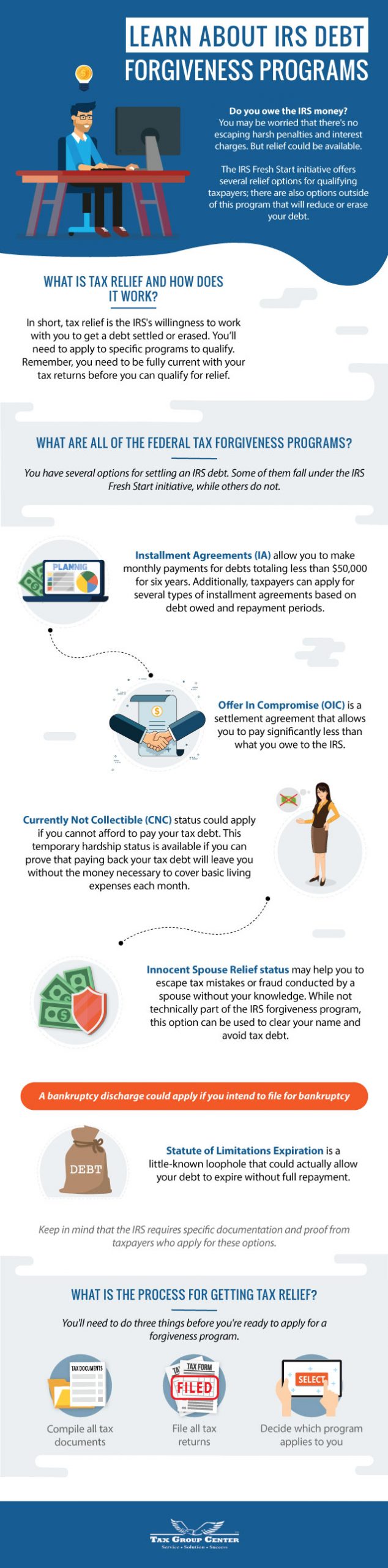

These are the most common ones. The IRS Debt Forgiveness Program presents taxpayers with several options to catch up on their unpaid taxes. Unfortunately that 10-year timeline is.

The IRS has the final say on whether you qualify for debt forgiveness. The IRS will forgive your tax debt if you are unable to pay it in full after 10 years. Debt forgiveness is when a lender reduces the amount of debt a creditor owes or wipes away the debt entirely.

These specific exclusions will be discussed later. The IRS debt forgiveness program is a way for taxpayers who owe money to the IRS to repay their debts in a more manageable way. Although you can apply for OIC on your own communicating with the IRS can be frustrating.

The IRS has 10. Debt settlement or debt forgiveness is a last-resort option that can help debtors get out from under overwhelming balances. The canceled debt isnt taxable however if the law specifically allows you to exclude it from gross income.

In Indiana for example the state tax rate is 323. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years. Offer in Compromise OIC With an Offer in Compromise the IRS accepts a.

The Education Department and advocates for debt forgiveness are encouraging borrowers. Debt forgiveness can help free up your financial resources and relieve a major burden. However the loan forgiveness element does not apply to private student loan borrowers who account for an estimated 8 of total outstanding student loan debt in the US.

Generally if you borrow money from a commercial lender and the.

How Does Tax Debt Relief Work An Ultimate Guide Centsai

Tax Debt Relief Irs Tax Settlement Defense Tax Partners

Best Tax Relief Options If I Owe 10 000 To 15 000 To The Irs

Tax Debt Relief 20 20 Tax Resolution The Tax Experts

Some States Could Tax Cancelled Student Loan Debt Kiplinger

Need Irs Tax Debt Relief Here S What You Have To Do To Get Help Credit Summit

Pin By Sally Ball On Creatives Irs Taxes Tax Debt Forgiveness

Irs Courseware Link Learn Taxes

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

What You Need To Know About Irs One Time Forgiveness

Tax Debt Relief 3 Ways The Irs Is Willing To Work With You Fidelity Tax

These 13 States Consider Student Loan Debt Forgiveness Taxable Income Cpa Practice Advisor

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com

Bankruptcy Faqs Income Tax Debt Faqs Tax Relief Faqs Wi Il Fl

Irs Tax Debt Relief Acclaim Legal Services

General Archives Irs Office Near Me

Payroll Tax Debt Relief How To Settle Tax Liability Tax Relief Center