corporate tax increase us

As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21. Investment however stayed at 24 from 2015 to 2019 while.

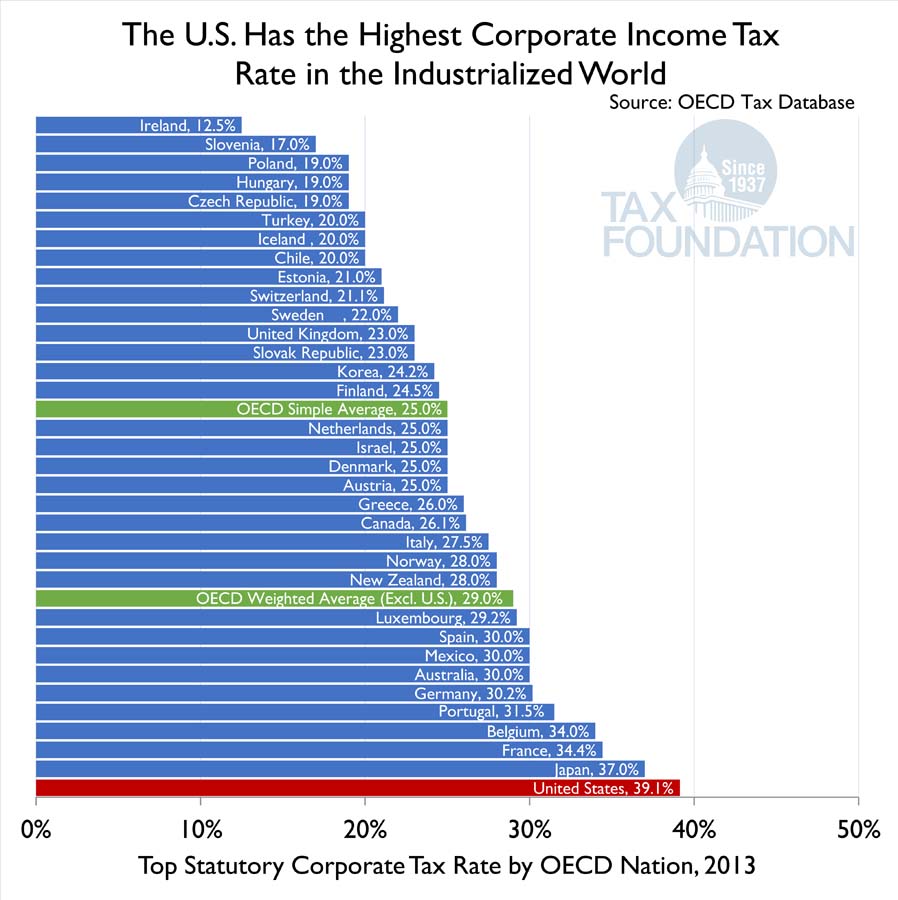

U S Corporate Tax Rate Poised To Become Highest Mar 27 2012

Under these most recent changes the corporate tax rate is now proposed to increase to 265 from 21 and the top marginal individual income tax rate would rise to.

. Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax rate. On 28 March 2022 the US Treasury Department issued General Explanations of the Administrations Fiscal Year 2023 Revenue Proposals. Worker and amounting to just 2 to 3.

Businesses with profits of 50000 or less around 70 of actively trading companies will. The reversal of Aprils rise in National. The legislation that provided for this increase also sets out.

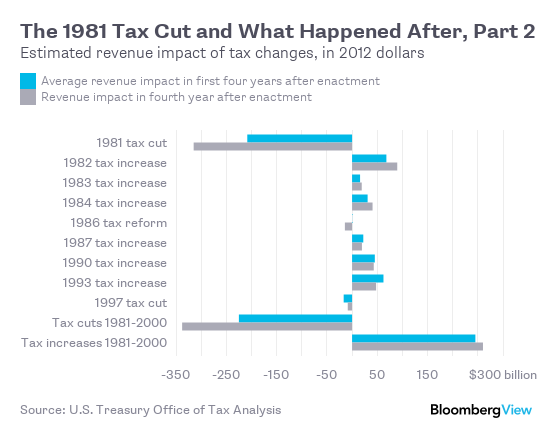

Well-publicized one-time bonuses for employees that companies announced after the tax cuts were modest overall averaging 28 per US. Bidens budget assumes the BBBA increases take effect and would pile on another 25 trillion of tax increases 16 trillion from corporate and international tax changes 780. Biden says he wants to raise the corporate income tax rate from 21 to 28.

In order to support the recovery the increase will not take effect until 2023. The corporation tax will increase to 25 from 1 April 2023 affecting companies with profits of 250000 and over. The Federal governments 2023 fiscal year that begins on October 1 2022 includes a proposal to increase C Corporations tax rate from 21 to 28.

This is President Bidens second. The tax plan would raise the corporate rate to 28 percent from 21 percent to help fund the presidents economic agenda. The increase in the corporate tax rate in the USA and the consequences for companies.

Businesses with profits of 50000 or below would. The budget would provide a total of 141 billion in funding for the IRS an increase of 22 billion or 18 above the 2021 enacted level with funding specifically earmarked for the. The government has today Friday 14 October announced that Corporation Tax will increase to 25 from April 2023 as already legislated for raising around 18 billion a year and.

The Government seeks to improve the integrity of the tax system by aligning the tax treatment of off-market share buy-backs undertaken by listed public companies with the. From today 6 November the 125 point cut to National Insurance rates for employees and employers takes effect across the UK. Proposed Increase of the US.

Raising the Corporate Rate to 28 Percent Reduces GDP by 720 Billion Over Ten Years. But Republicans are already. In our new book Options for Reforming Americas Tax Code 20 we illustrate the.

The 2017 bill lowered the corporate tax rate from 35 to 21 in an effort to increase investment and workers wages. America will have to compete to attract this investment but the Democrats proposed increase in corporate tax from 21 percent to 265 percent would crowd it out. The White House and party leaders in Congress have been planning an increase in the corporate tax rate to at least 25 per cent from 21 per cent along with increases in individual income and.

The 28 tax rate would be effective for. Send any friend a story As a subscriber you have 10. In 2017 when corporations were subject to a.

Once the corporation tax rate increase takes effect in April 2023 the applicable corporation tax rates will be 19 and 25. The rate was cut from 35 in 2017 under Bidens predecessor Donald Trump.

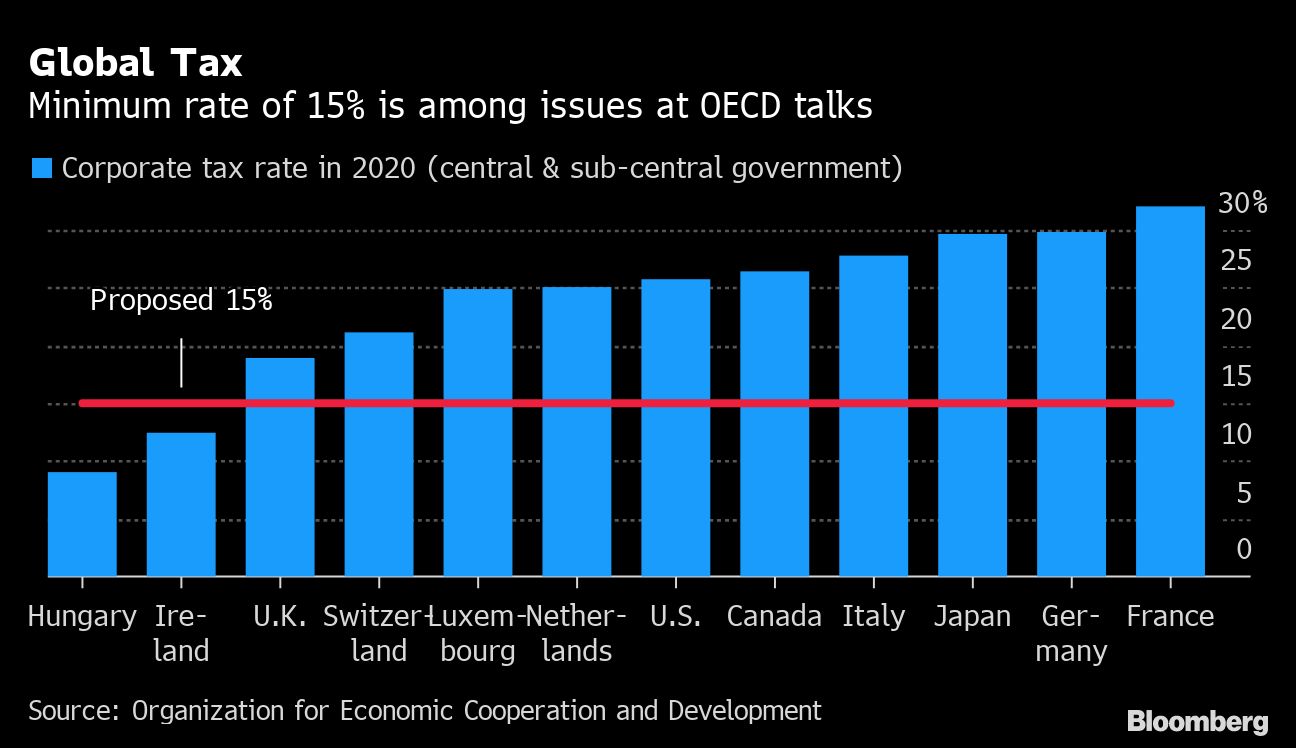

Global Minimum Tax May Not Make It Past The U S Congress Treasury Risk

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

What Should Corporate Tax Reform Look Like Center On Budget And Policy Priorities

Corporate Tax In The United States Wikipedia

Biden S Business Tax Hikes Would Be A Self Inflicted Mistake For America The Heritage Foundation

Jeroen Blokland Twitterren The Us Effective Corporate Tax Rate Over Time Something Seems Off Https T Co 2ignoxy9tx Twitter

The Mostly Forgotten Tax Increases Of 1982 1993 Bloomberg

The U S Has The Highest Corporate Income Tax Rate In The Oecd Tax Foundation

Biden Corporate Tax Increase Details Analysis Tax Foundation

Tax Overhaul Winners And Losers Seeking Alpha

Trump S Corporate Tax Cut Is Not Trickling Down Center For American Progress

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

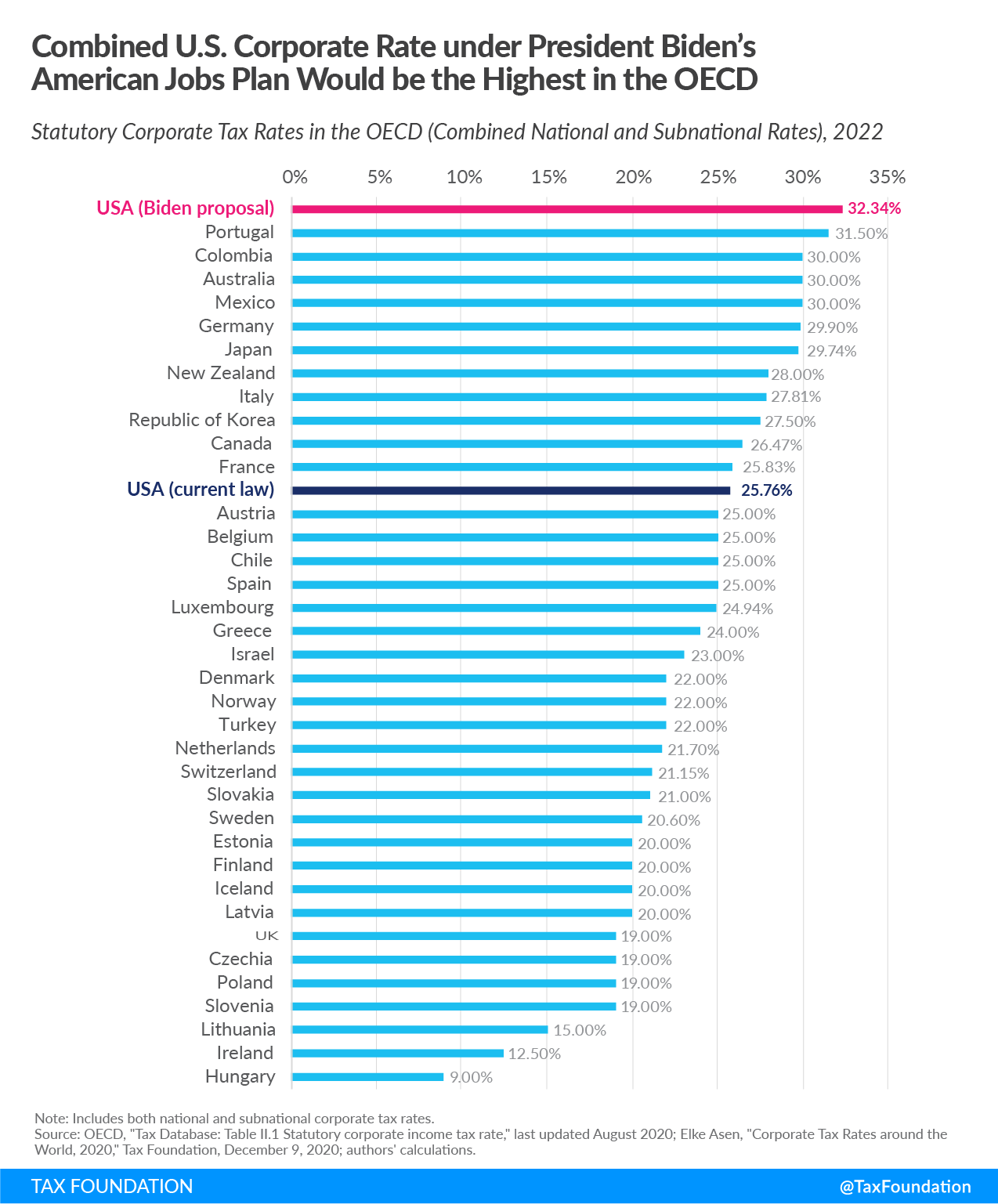

Tax Foundation On Twitter President Biden S Americanjobsplan Would Increase The Federal Corporate Tax Rate To 28 Which Would Raise The U S Federal State Combined Tax Rate To 32 34 Higher Than Every Country In

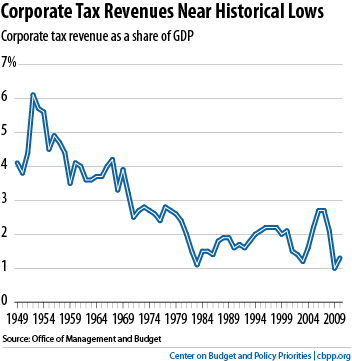

The History Of Us Corporate Taxes In Four Colorful Charts Mother Jones

/cdn.vox-cdn.com/uploads/chorus_asset/file/9498929/Corporate_tax_rate_graphic.PNG)

Trump S Economists Say A Corporate Tax Cut Will Raise Wages By 4 000 It Doesn T Add Up Vox

Corporate Tax In The United States Wikipedia

Impact Of Lower Corporate Tax Rate The Leuthold Group Commentaries Advisor Perspectives

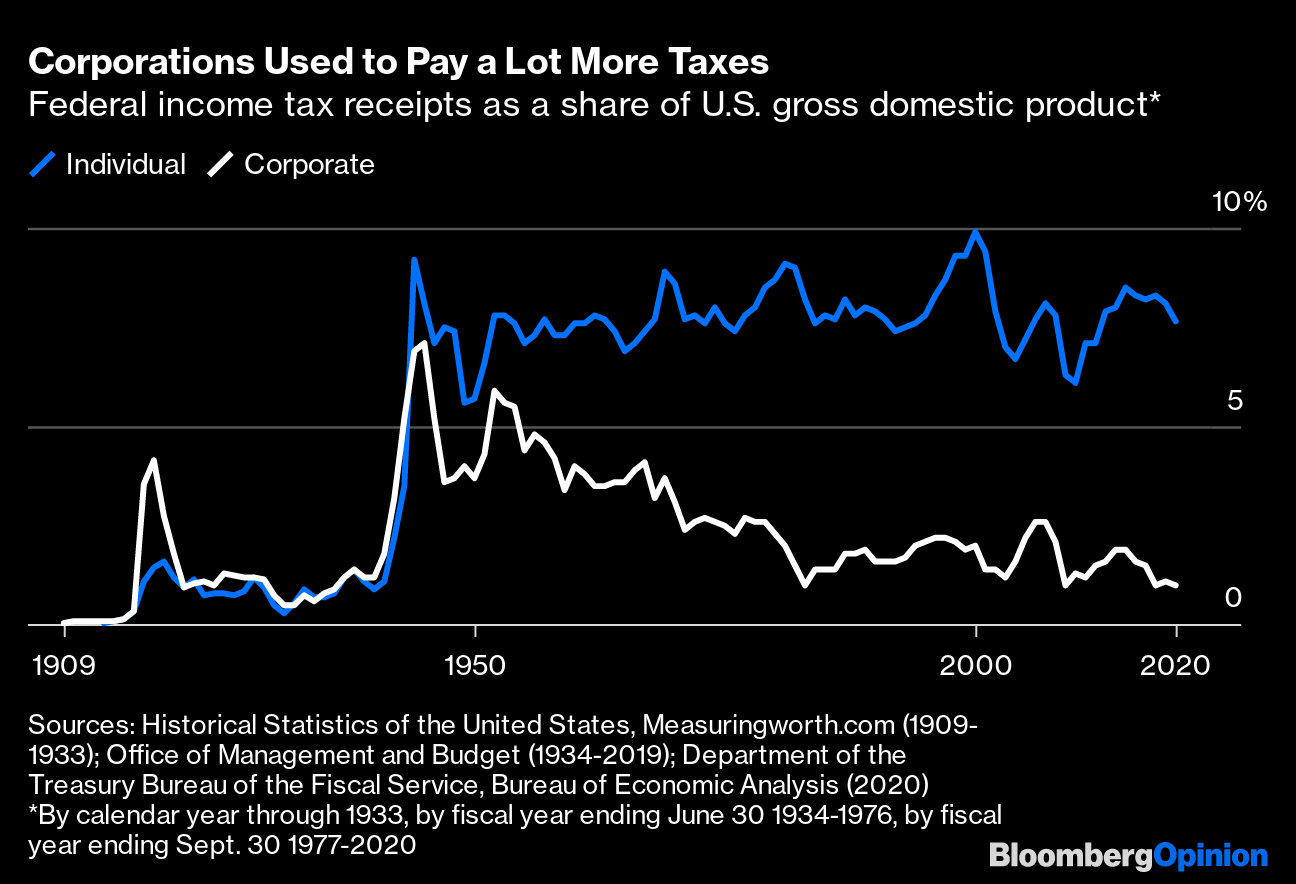

Corporate Income Taxes Have Been Shrinking For Decades Bloomberg

Five Charts To Help You Better Understand Corporate Tax Reform